Demystifying the Planning Process

If a financial advisor told you that it’s time to create a financial plan, what is the first thing that comes to mind? Your first thought may be “Yeah, it’s about time to map out my retirement.” Some people will ponder opening an investment account so they can buy stock in their favorite companies, yet others simply want help creating and sticking to a budget. Although none of these ideas are wrong, none of them make up a financial plan on their own; rather, they are just pieces of the overall puzzle. If these ideas are just parts of a plan, then what would the entire process look like?

Financial planning is the process of managing your finances so you can accomplish your goals while working to navigate through the challenges life will inevitably bring you. Some people may be able and willing to do this process on their own while others would prefer professional guidance.

At Aurora Financial Strategies, one of our primary focuses is to create a financial plan that will propel you toward your financial goals. Our team has created a structure for going through the financial planning process that is similar no matter which member of our team is assisting you. We also believe it’s important that you understand said process as clear communication is necessary to the relationships we have with our clients. After all, we are a team of fiduciaries. This blog will provide some transparency and clarification as to what the Aurora planning process actually looks like.

The Process for Creating a Financial Plan:

Introductory Meeting

Data Collection

Risk Tolerance Assessment

Determining Net Worth

Creating A Unique Plan

Plan Presentation

Take Action

Monitoring and Updating Your Plan

Step 1: Introductory Meeting

Your first meeting with Aurora is all about discovery: the advisor has an opportunity to learn more about the client’s personal life and financial circumstances. The client gets a chance to learn more about the advisor and our team. This initial meeting is almost like an interview as it provides the client with the opportunity to figure out if our team is the right one to handle their questions and concerns. At the end of this meeting, the client and advisor will decide if they are a good fit and would like to work together.

Step 2: Data Collection

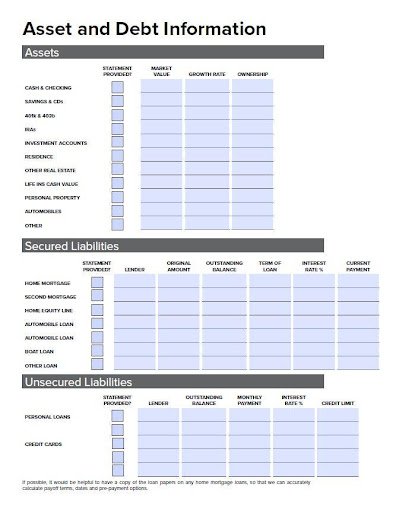

To ensure that we have the necessary information to create a financial plan for you, we ask our clients to fill out a “fact finder,” which is a document that asks the client for various pieces of information. This information includes contact information, questions about you and your household, a list of potential financial goals, a list of your assets and liabilities, your current life and health insurance coverage, and your desired age of retirement and retirement spending amount.

In addition to a completed fact finder, we may also ask for statements that help us determine your level of income, such as pay stubs, pension or 401(k) statements, Social Security benefits statements, previous tax returns, and more. All of this information paired with the advisor’s notes from the initial meeting is used in creating your financial plan.

Once all the needed information has been gathered, we then need to have a conversation about your risk tolerance.

Step 3: Risk Tolerance Assessment

The next step on our list is helping you determine your risk tolerance. Your tolerance is often determined by how you view risks in general, the goals you have for the future, and your understanding of how investments and the overall market work. We like to have conversations about risk tolerance before beginning the planning process. Our goal is to make our clients as comfortable and as confident as possible with the plans we create for them; therefore, it is important to us that we understand the level of risk a client is willing to take so that we do not suggest recommendations that they are uncomfortable fulfilling.

Step 4: Determining Net Worth

Once we have your data gathered and risk tolerance determined, we can start entering your data into our planning software eMoney. To calculate your net worth, eMoney will subtract the sum of your liabilities from the sum of your assets. It’s really that simple!

Your household’s total annual income will also be needed as the present day’s earnings affect future results. Income can come from several different sources, including wages, self-employment income, investment income, rental income, and more. No matter what your source of income is, your annual income is essential for your advisor to know as it will help them better understand your tax implications, savings and contributions, and living expenses.

Step 5: Creating a Unique Plan

At Aurora, each of our clients has unique needs and desires, so it is important that we create a plan geared toward each client. We do not make cookie-cutter suggestions as nobody’s financial situation looks exactly the same. In order to create a personalized financial plan, Aurora will analyze your debt, insurance, and tax situations, help you prioritize and fund your financial goals, and help you invest your money in a way that makes the most sense for your circumstances and risk tolerance. Creating your unique plan will consist of five steps.

Debt Analysis

For our clients that carry debt, efficiently paying back what you owe is a crucial part of most financial plans. Our debt analyses show our clients how much they should allocate monthly on each debt, how much money they can save in interest payments if the payments are made as efficiently as possible, and when each debt is expected to be paid off.

Typically, the faster we can help you pay off your debts, the better off you’ll be in the long run. We often suggest knocking out debts with the highest interest rates first in order to save money on accrued interest. One method we commonly have our clients use is the concept of snowballing your debts, meaning that you will add extra payments to a specific debt each month once a different debt has been repaid. For example, if you finished paying off an auto loan at $750 each month, we would suggest that you would apply that $750 to the debt with the next highest interest rate in order to help pay the remaining loans off faster.

Sometimes, the benefits of liquidity or saving extra money outweigh the benefit of paying off debt quickly. Debt repayment can be tricky to figure out, so leave it to us! We’ll tackle the issue and present it to you in a way that you can easily comprehend.

Insurance Analysis

Making sure our clients have proper insurance coverage is another key part of the financial plan. While we encourage our clients to accept insurance coverage through their employers, sometimes a client may need additional coverage. Aurora is able to help clients purchase life, medical, disability, and long-term care insurance.

Although we are mainly concerned about the types of insurance that affect our clients’ financial plan, we are more than happy to connect you with insurance professionals that can help you purchase coverage on your home, automobile, and more.

Tax Planning

A well-constructed tax strategy can save our clients money on their upcoming tax bills. Aurora can help you determine if you are withholding the correct amount from each paycheck for taxes as well as make suggestions about how to qualify for certain tax deductions and credits.

While we don’t prepare tax returns, we would be happy to point you toward an accountant or licensed tax professional to file on your behalf.

Funding Short- and Long-Term Goals

Aurora will help you identify and prioritize your financial goals, both short-term and long-term. These goals may include but are not limited to, vacations, purchasing a new home, saving for your child’s education, or saving for your retirement. After determining your financial goals, we will weave your goal funding into your financial plan. We help our clients determine how much money is needed for certain goals and how often savings payments need to be made, as well as when it is the most appropriate time to withdraw money from their accounts.

Selecting the Appropriate Investment Portfolio for You

Based on your risk tolerance and goals, Aurora will determine which of our portfolios would be most suitable for you. Whether you are a conservative investor or someone who is able and willing to take on more risk, by balancing how much of your money would be held in stocks, bonds, and cash, Aurora can help you find a portfolio that is both comfortable and effective.

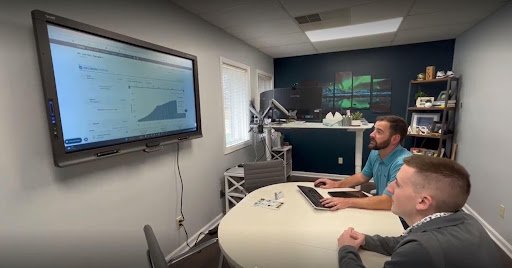

Step 6: Plan Presentation

Once your financial plan has been created, a member of our team will reach out to you about meeting with us to go over your plan. We offer in-person appointments as well as Zoom calls and phone calls, so meeting with us is easy even if you don’t live in central Indiana.

During the meeting, we will go over every piece of your plan: Your net worth, insurance, taxes, short-term and long-term goals, investments, retirement age, spending, etc. This meeting is a great time for you to ask your advisor any questions you may have. These can be questions relating to your plan, or other items that you have not brought to our attention yet. Your advisor will be happy to answer any and all questions you have while going through the plan presentation.

Step 7: Take Action

As the meeting wraps up, it is likely that there will be action items for both you and your advisor to take. There will be tasks that only your advisor can do, and others for you to complete. For your tasks, your advisor will gladly talk you through the process if you need help. Post-plan tasks may include calling your old 401(k) provider with your advisor, sending your advisor updated account statements, completing new account applications, updating your beneficiaries, and more. Many of these action items require a team effort; therefore, it is important that advisors and clients work together to best implement a financial plan.

Step 8: Monitoring and Updating Your Plan

Transitioning to different stages of life often brings about a different set of circumstances. As life begins to change, it’s common for your goals, as well as your needs, to change as well. When your financial priorities change, it’s important to communicate those changes with your advisor. Common reasons to update your financial plan would be: you want to retire as early as possible, move to a bigger home, travel more often, save more money for retirement, or even spend more than you previously were. Your advisor will help you update your financial plan to best accommodate your new life updates. Communication is key. Your advisor won’t know about these changes unless you tell them! Even if there aren’t any significant changes happening in your life, it will still be helpful to meet with your advisor at least once a year to remain on the same page.

Summary

Creating a financial plan requires some work and effort, but that doesn't mean the process needs to be stressful. At Aurora, it’s our duty to serve our clients by helping them live financially healthy lives while trying to alleviate as much financial stress as we can. We want our clients to feel comfortable and confident with the plans that we have created for them, and we’re confident that we can help make that a reality.

Still have questions? Please check out our FAQs page or give us a call!

Investment Advisory Services are offered through BCGM Wealth Management, LLC dba Aurora Asset Management (Aurora). PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client’s specific financial needs, goals and objectives, time horizon and risk tolerance. Advisory services are only offered to clients or prospective clients where Aurora and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Aurora unless a client service agreement is in place.