Lovesac! Baby Lovesac!

· We recently increased our position in Lovesac (LOVE) for many of our clients

· Our models indicate the stock is worth approximately $61/share vs the price of $24.34 as of market close 10/31/2022

· Lovesac has a differentiated product line and business model conferring multiple sustainable competitive advantages

· Retail concepts can be volatile businesses. Do your own due diligence prior to investing.

LOVESAC IS A LITTLE PLACE WHERE…WE…CAN…SIT TOGETHER!...LOVESAC BAAABYYY!

10/31/2022

Executive summary

The furniture industry is stale and ripe for disruption, replete with inflexible products designed to be discarded. The products are expensive to ship, difficult to move, and of want for innovation. Enter Lovesac. With a first principles, Designed for Life philosophy that seeks to change the way we think about furniture. Roughly 88% of Lovesac’s revenue is generated by “Sactionals” which are a modular couch. It is made up of two pieces, seats and sides that can be easily shipped, moved and rearranged. This means low cost logistics for the company and a product that can last a lifetime for the consumer as they add pieces or rearrange to their heart’s desires. The covers can be taken off, washed and swapped out providing endless styles to meet a customer’s changing tastes.

The company has a number of additional innovations including StealthTech which turns your couch into an immersive, surround sound experience without all the exposed wires and speakers. As a retail concept, only Apple and Tiffany can boast higher sales-per-square foot ($2,742 as of most recent report) as the small number of SKUs (number of products) and premium price points enable showrooms with extraordinary unit economics. This is an innovative business that holds 64 patents (as of January 2022) that continuously raises the bar for furniture. It’s limited SKU count means they can ship furniture to customers in days vs. weeks or months for competitors. The modular design allows Lovesac to fit 450 sactional units on a truck vs 45 traditional couches for competitors. It also means customers have their couch within days of ordering (shipped via FedEx) vs. weeks or months with most alternatives. Much of their product is actually produced with discarded items. Their Sacs (giant bean bags) and Sactionals use upholstery made from 100% recycled plastic bottles. They are shipped in recycled cardboard. Since its founding, the company has used recycled waste foam from other furniture manufacturers to produce the Durafoam in its Sacs. Turning waste into premium products is simply good business.

Lovesac employs these advantages to grow at a high rate while the stock trades at what we perceive to be a tremendous value. We expect the company to continue growing for the foreseeable future as they take share from incumbents and expand their margins as they leverage their fixed costs.

Source: Company Report

Humble Beginnings

The Lovesac concept began in 1995 with a recent high school graduate (Shawn David Nelson) who thought it would be funny to make a giant bean bag. Shawn would take the 7-foot-wide bean bag camping and to drive in movies where he started getting requests from people who wanted their own. Lovesac was formed as a company in 1998 as a tiny operation until Limited Too placed a 12,000 unit order. From there, Shawn found fabric suppliers in China and learned how to mass shred the now patented durafoam (the guts inside the sacs) with a used haybuster powered by a John Deere tractor. By 2001, after being turned away as a supplier to the large furniture chains Lovesac opened their first retail location in Salt Lake City, Utah. From that first store, they started to sell franchises and started expanding. (4)

Lovesac’s Failures and the Subsequent Turnaround

For this section, I’d simply like to quote directly from an article that describes a difficult period in Lovesac’s corporate history.

From there, Lovesac went on to “fall into the traps of every home furnishings retailer on the planet.” The company began accepting franchise offers, eventually learning how difficult it is to maintain control over the brand and the success of each storefront. Lovesac also expanded its product offerings to include decorative accessories, weighing even heavier into the merchandising cycle of seasonal rotations and excess inventory. But it did have one line item going for it: the sectional, a two-part modular sofa that softly launched in 2006.

It wasn’t until 2006, following Nelson’s appearance on an entrepreneurial reality TV show, that Lovesac caught the attention of venture capitalists. They worked fast, filing the company, which was at the time $2 million in debt, for Chapter 11 bankruptcy. Lovesac closed its unprofitable locations, exited the franchising model and scaled back its product offerings.

“You learn more through a reorganization—if you’re able to survive it—than you ever could through two years of an MBA,” says Nelson in the latest Business of Home podcast. “We’ve exited all those merchandising traps. We don’t generate any of that excess stuff anymore, and we’ve become totally vertically integrated, deep into couches. We’re focused on that, and we’re not interested in those other categories. And that’s how we’re winning.” https://businessofhome.com/articles/from-bankruptcy-to-ipo-how-shawn-nelson-built-america-s-fastest-growing-furniture-retailer

BUSINESS OVERVIEW

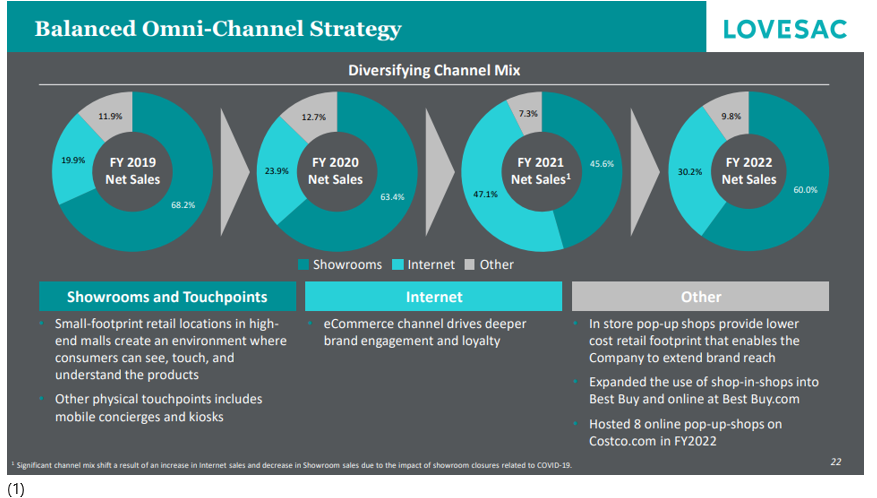

Lovesac is an omni-channel furniture brand primarily selling products through its own physical and digital retail channels in addition to distribution through Best Buy and Costco. In all, the company has 174 retail locations including 158 Lovesac branded showrooms, 2 mobile concierge and 14 kiosks. In addition, they have 22 Best Buy shop-in-shops and operate temporary online pop-up-shops at Costco locations. Their target market is 25-45 year old “young parent want-it-alls”. Sales are dominated by modular couches called “Sactionals” (introduced in 2006) making up almost 88% of sales. Lovesac’s original product “Sacs” are essentially oversized bean bags and make up almost 11% of sales. The remaining sales are in the form of accessories to complement the main two product lines like blankets, pillows and attachments to the Sactionals such as drink holders and seat tables. Sales, divided by channel are as follows: showrooms (60%), internet (30%), and Costco and Best Buy (10%). The company’s growth plans include expanding their retail footprint in the US, launching new products, and eventually expanding internationally. The covers are manufactured in the US, while the stock products are made in China, Vietnam, Malaysia, Taiwan, Indonesia and India. All the manufacturing is outsourced. (1)

(1)

Company Financials

Sales are growing at a blistering pace as the company opens up new showrooms and drives increased sales through existing showrooms (comparable showroom sales). We expect the company to maintain relatively high gross margins while operating expenses should decline as a percentage of revenue. This could lead to expanding operating margins and net profits that grow faster than sales until the company reaches a mature state.

What Problems Do They Solve?

Traditional furniture is designed to be used and discarded. Typically, we buy chairs, couches, etc. with a specific room arrangement and a particular style in mind. As our lives change, so do our tastes and needs. Perhaps we would like a different arrangement or color. Perhaps we move to a new home that calls for a larger couch. Maybe the kids stain the fabric. Typically, these kinds of events create a need to replace our existing furniture. They aren’t designed to evolve with our lives.

Lovesac has turned this dynamic on its head. The company ethos is built around “Designed for Life” with products that are built to last and can evolve with our needs. The company’s Sactional is the perfect embodiment of this concept. The product consists of two types of pieces: seats and sides. These can be rearranged to fit new layouts whether you need to accommodate a Christmas tree, movie night, or change of mood. If you want a larger couch, you can simply add on rather than replace the entire thing. If you want a smaller couch, you can make part of it into a chair and place it somewhere else. They can even be arranged in the form of a bed to make your guests more comfortable. If you have enough pieces, the possible configurations are bound only by imagination.

The covers can be removed and placed in the washing machine to make cleaning or stain removal easier. When you are ready for a new look or feel, Lovesac has a wide assortment of more than 200 covers with a huge variety of colors and textures to choose from.

Finally, when you are ready to move to a new home, the couches can be broken down to “seats and sides” meaning no more Ross Geller moments 😊!

As an illustration, I created my own Sactional (pictured below) with the company’s build tool. You’ll notice these bad boys sell at a premium. My masterpiece came out to over $12,000 which included the company’s New Stealtech offering which embeds surround sound into the couch itself.

Economic Moat (Quantitative) – Can they Protect Profits?

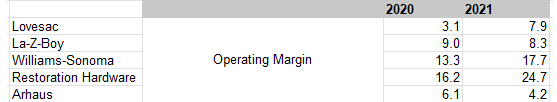

If, in fact, Lovesac has a durable competitive advantage you should expect to see that in comparing their financials with competitors. In making comparisons, I selected some of the strongest furniture brands and retailers to see if Lovesac measured up.

First, it’s worth mentioning that Lovesac is considerably smaller than this group as measured by total sales.

Lovesac has the highest gross margins of the group. This is not explained solely by high price points as most of these competitors offerings are at similar ranges. I believe the difference lies within the modular couch framework and small store format that generates competitive advantages discussed elsewhere in this blog.

Where Lovesac has room for improvement are its operating costs (SG&A). This is not surprising as smaller businesses are not able to benefit from the same levels of scale. A big chunk of that is marketing spend. Lovesac spends more aggressively than their peers in pursuit of growth. They have shown improvement on driving operating costs down as a percentage of revenue and a continuation of that trend is central to our thesis.

Lower SG&A as a percentage of revenue while maintaining high gross margins should allow Lovesac to grow operating margins, which are still lower than several of their peers. Restoration Hardware is impressive here as they have coupled high gross margins with a very efficient fixed cost structure. I do not believe it is realistic to expect Lovesac to drive profitability that high anytime soon, but it is illustrative of where they could go.

Lovesac had an ROIC of over 25% in their latest fiscal year, well in excess of their cost of capital and very competitive for the peer group. Given that they currently reinvest back into the business as opposed to issuing dividends or executing buybacks, this will lead to tremendous growth if they can sustain ROIC’s at these levels. I would expect this number to continue to climb assuming they can drive further operating leverage.

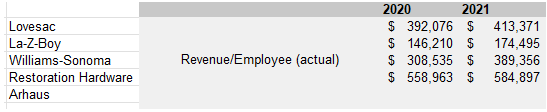

Lovesac is able to generate revenue per employee of over $400,000. In combination with the highest gross margins, this is very illustrative of a concept that is competitively advantaged and should drive increased profitability with scale.

As a last point, remember that Lovesac’s sales per square foot are ahead of all furniture retailers that disclose the data at $2,742 (1) behind only Tiffany and Apple in the broader retail market.

Below are some further data points on the economics of their showroom model, new customer counts, and the growing value of customer relationships over time. (1)

In summary, Lovesac is clearly ahead in some metrics like gross margins and sales/sq ft. They have the opportunity to challenge the leaders in the industry on other metrics if they can effectively scale their operations.

Economic Moat (Qualitative) – Can they Protect Profits?

The furniture retailing industry is incredibly competitive so, in addition to quantitative evidence of a moat, it’s helpful to have some qualitative information to provide more confidence this level of profitability is sustainable.

· Patents – As of January 2022, Lovesac has 64 issued patents including for some products that have not yet made it to market. This creates a barrier to entry for competitors and exemplifies the company’s constant pursuit of innovation to delight the customer.

o It should be noted that Lovesac recently settled with Joybird (subsidiary of La-Z-Boy) in a suit Suit that accused Joybird of patent infringement. Terms were not disclosed.

· Inventory – Limited SKUs (mostly “seats” and sides”) allow orders to be shipped to the customer in days at a significantly lower cost than traditional couches. It also means they can operate with a small-store format that leads to the next bullet point.

· Retail format productivity - “So, even more impressive is our industry-leading sales per square foot productivity with only Apple and Tiffany ahead of us, as we look at the most recent data.” (Earnings Call on June 8th 2023)

· Brand – Lovesac is the leading brand for modular furniture and is supported by ample marketing spend. As an example of the power of the brand, 41.6% Lovesac transaction are from repeat customers. (1)

· Focus – Lovesac focuses on a small set of products in the furniture industry that is flexible enough to reach a broad market.

It is essential to our thesis that Lovesac continues to focus on maintaining and growing their moat to ensure profitable expansion of their business. Should Lovesac fail in this endeavor, it would create considerable challenges for the business and likely expose investors in its stock to considerable downside risk.

Governance - Can we Trust Management?

The primary focus here is to determine to what extent and the nature of agency risk in the investment. Agency risk is a conflict of interest for a party that is hired to act in the best interest of another. We review a company management’s business and capital allocation decisions with the context of their incentive structure and ownership activity to determine the level of risk. Ideally, management’s incentives and decisions are as closely aligned as possible to the interests of long-term shareholders.

Overall, we view Lovesac governance as above average.

Pros:

· Founder – Shawn David Nelson led the company since inception (1998) and increased his ownership level since the IPO in 2018. We believe founders tend to have a more personal and reputational commitment to the success of their firms.

· Investor Involvement – The Chairman and several directors have large, long-term ownership stakes in the business both personally and through their investment firms.

Cons:

· Executive Incentives – While we find no evidence that this has led to poor capital allocation to date, the nature of incentive structure poses risks that may become a problem in time if the structure doesn’t evolve as the business matures. The bonus structure largely hinges on 1-year targets for revenue, adjusted EBITDA, and customer satisfaction scores. The risk is that without a component tied to returns on invested capital (ROIC) management could make value destructive capital allocation decisions in pursuit of those growth targets. We believe that because the growth opportunities appear abundant that this risk may not be an issue in the short term, but we would prefer an alternate incentive structure to be considered as the company matures and enters into a different moat stage

· Potential Dilution – Related to the bullet point. Lovesac is reliant on equity issuance to incentivize management and other top talent (as most sizable companies are), a period of weak stock prices could lead to elevated levels of shareholder dilution. Currently, the run rate appears manageable but it is worth consideration.

Valuation – Is there a Margin of Safety?

As a start, it’s worth looking at the company’s metrics on a Price to Earnings and Price to Sales basis. On that note, the stock is trading at the cheapest levels it has ever seen. I believe this is because investors are avoiding/selling stocks that are tied to consumer activity due to expectations of a looming recession. While we may be in or near a recession, those conditions often create opportunities to buy stocks in consumer companies for tremendous discounts to intrinsic value.

Source: FactSet Research Systems

To value this company, I created a discounted cash flow model and forecasted 3 different scenarios to test the sensitivity of value to different variables that drive the business. These scenarios do not encapsulate all the possibilities for the business. Actual results may be significantly better or worse than my projections. This is simply an exercise to estimate the intrinsic value of the company given my view of a reasonable range of outcomes for the business.

For context, (LOVE) Lovesac closed trading on 10/31/2022 at $24.34 per share.

· Bear Case Scenario ($17.55 Fair Value) – In this scenario, a recession in 2023 leads to a modest sales decline despite the increase in showrooms. Competitors aggressively copy Lovesac’s offerings to reduce product differentiation leading gross margins to decline over the forecast period. The fall in gross margins offsets the SG&A scale.

· Base Case Scenario ($61.69 Fair Value) – In this scenario, Lovesac weathers a recession reasonably well and moderates showroom count growth over the next decade. Gross margins decline slightly as competition heats up but they are able to innovate enough to keep them at or above 50%. Lovesac is able to generate operating margins of 13% by calendar year 2029.

· Bull Case Scenario ($204 Fair Value) – In this scenario, Lovesac continues to innovate ahead of the competition maintaining gross margins of 54% while successfully expanding the concept to 566 showrooms in the next decade. They are successful in driving operating margins to 19% by calendar year 2032.

As you can see, the range of outcomes is extremely wide. For this reason, retail companies can be difficult to value. Should the profitability of the business deteriorate, fair value of the company could be much lower than I have forecasted. As a result, we believe they require a high margin of safety to warrant investment consideration. For me, Lovesac meets this test.

Risk

While I attempt to capture risk within my valuation framework, the greatest risk is often in the unknown. I foresee the greatest risks to this investment to the long-term competitiveness of the Lovesac product suite vs. the competition. However, it is possible there are holes in my thesis I have not yet found that could materially depress the intrinsic value of the company. This is not investment advice. Do your own homework prior to investing.

Further Reading/Sources

1.) https://investor.lovesac.com/

4.) The Lovesac Story - https://www.youtube.com/watch?v=ZcLx__-JzCw

5.) https://lovesac.typepad.com/shawndnelson/

8.) Settlement with Joybird - https://www.furnituretoday.com/retailers/lovesac-joybird-reach-amicable-resolution-to-patent-suit/

9.) Patents Filed - https://patents.justia.com/assignee/the-lovesac-company

10.) General Patent Info - https://www.traskbritt.com/what-is-the-life-of-a-patent-in-the-us/

11.) Competition - https://www.livingcozy.com/blog/modular-sofas

In Summary

At Aurora, we are constantly looking for “the right pitch” in our sweet spot where we believe the probabilities are in our favor. This blog represents our thinking at the time of publication. By the time you read this, our opinion may have changed. If you are a DIY investor, use this only as a starting point for your research and be sure to do your own due diligence. For questions regarding our individual stock strategies, please reach out to us!

Invest Curiously,

Austin Crites, CFA

Austin Crites is the Chief Investment Officer of Aurora Financial Strategies, a financial advisory firm based out of Kokomo, IN. He can be reached via email at austin@auroramgt.com. Investment Advisory Services are offered through BCGM Wealth Management, LLC, a SEC registered investment adviser. This blog does not constitute advice. This is not an offer to buy or sell securities. Advisor is not licensed in all states. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. BCGM Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Clients may own positions in the securities discussed.